UPDATE 2025

The BC NDP government has fast-tracked the value of $20 billion in LNG and mining projects

Jessica Clogg of West Coat Environmental Law said she worries the province is using tariff threats to drum up support for projects that might otherwise face more scrutiny.

“I do think it’s shameful that resource companies and the business sectors are taking advantage of the current economic instability to apparently put forward a list of potentially risky projects,” she said.

CBC news: B.C. fast-tracking 18 resource projects to reduce reliance on United States, Feb 4, 2025

UPDATE 2023

Vancouver, Dec 18, 2023, According to the most recent figures available from BC Stats, the provincial government’s statistics office, coal and natural gas together accounted for nearly 31 per cent of B.C.’s exports.

BC Green Party Leader Sonia Furstenau, the MLA for Cowichan Valley, said ending subsidies to fossil fuel companies would be a good first step in cutting emissions. “Stop propping the industry up. That’s No. 1.

“We’ve gone way off course in B.C. in that the biggest polluters are paying the least,” Furstenau said. “To tax the biggest polluter less than half is really the reversal of what carbon pricing should have been.”

- The Tyee: Eby Defends BC’s LNG and Coal Exports, Dec 2023

- Dogwood: Oil and gas lobbyists target B.C. government 1,032 times in nine months, Sep 2023

- The Breach: Despite NDP promises, industry’s grip on B.C. government is tight as ever, May, 2023

Vancouver, July 16, 2018, Massive subsidies are quietly reviving LNG

“Shell does not need handouts from the government,” Horgan [BC NDP] said back in 2013.”

“In March[2018], Premier John Horgan announced another $6 billion worth of tax breaks for the LNG Canada project[in which Shell has a large stake], despite having criticized the last [BC Liberal] provincial government for its LNG incentives.”

Vancouver, July 16, 2018, BC Taxpayers Digging Deep for LNG Subsidies, Tax Breaks

From cheap power to low taxes, companies winning special benefits from government.

Victoria, March 22, 2018, BC NDP Premier offers more subsidies and tax breaks to the LNG industry proponents.

‘The NDP’s new framework offers LNG Canada and other companies tax reprieves and exemptions and a cheaper electricity rate than the previous B.C. Liberal government extended to the industry. The government is also offering a carbon tax break to LNG companies if their facilities can meet the “cleanest” operating standards in the world.’

Woodfibre LNG donated $38,000 to the BC NDP in 2016, the year ahead of the 2017 provincial campaign.

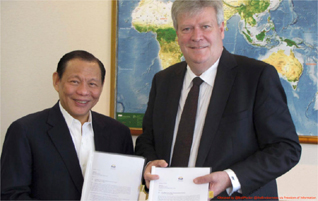

Sukanto Tanoto (left) and Rich Coleman, holding documents the BC Government refuses to release. See Breaker news article for details.

The LNG industry in BC as been offered and has demanded a list of subsidies. It is by now unclear that the province will see revenue from LNG at all.

Here is the list of the Provincial and Federal tax breaks/cuts and subsidies for the LNG industry:

- BC Hydro LNGeDrive rate: a reduction of the regular rate from $83.30 to $53.60 per Mega Watt Hour (MWH), this rate-cut is the equivalent of every one of the 100 jobs from this project being subsidized by at least $340,000 per year.(1)

- LNG tax cut from 7% to 3% for the LNG industry. Companies are able to deduct the full capital costs of their LNG plant investment before they pay the full 3%. (This could take 6-12 years depending on what price they are able to get in Asia. If there are capital cost over-runs, as in the case of Australian LNG or Canadian tar sands, it could be as much 16 years before the full tax kicks in.)(2)

- There is early 1.5% tax to get some funds into the Treasury but those funds are deductible from the full 3.5% tax.(3)

- A Corporate Income Tax (CIT) credit for LNG producers for its cost of natural gas. That works out to be equivalent to a CIT cut from 11% to 8%. Once we factor in the delayed application of the LNG tax and cost over-runs, this CIT reduction essentially wipes out any revenue gain from the LNG tax.(4)

- LNG producers may be eligible for the PST exemption for Production Machinery and Equipment obtained for use in the extraction or processing of natural gas.(5)

- If the LNG is being produced for the purpose of sale, including exported for sale, the natural gas purchased by the producer of the LNG would be exempt from PST.(6)

- BC’s royalties on LNG are not paid on units of gas, but rather on the net-profits of the LNG producer/exporter. If there is no profit, BC will get zero royalty income from a project.(7)

Footnotes:

(1) From announced by BC Government Nov 4 2016

(2) Path to Prosperity? Canadian Centre of Policy Alternatives, April 30 2014

(3) Path to Prosperity? Canadian Centre of Policy Alternatives, April 30 2014

(4) BC Government website: Provincial Sales Taxes

(5) BC Government website: Provincial Sales Taxes

(6) BC Government website: Provincial Sales Taxes

(7) Path to Prosperity? Canadian Centre of Policy Alternatives, April 30 2014